Bengaluru, Karnataka Mar 24, 2021 (Issuewire.com) -

Revolutionary Algorithm

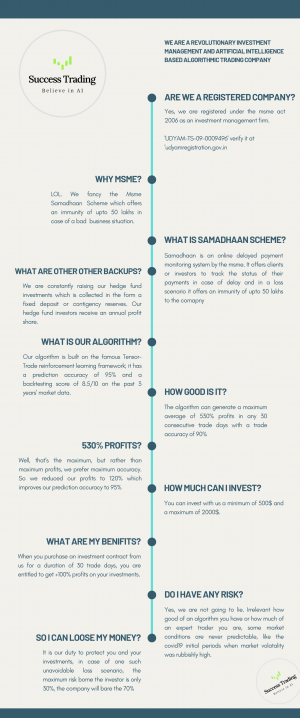

In the year 2018, I came across an open-source repository on GitHub named ‘RL-Trader’ by Adam King. It was a reinforcement learning environment created to build and test algorithms on cryptocurrency trading. India by then was already beginning to ban cryptocurrencies and I personally was never a fan of crypto. Thus I wanted to change the framework and build algorithms to use on general stocks, metals, and currency pairs. It was not a simple task and I eventually gave up after 4 months. Soon enough, the RL-Trader project was shut down and reopened as ‘Tensor Trade’ which is a brand new version of Reinforcement Learning Framework, to create and test algorithms on infinitely any stock available in the normal markets. This gave me a fresh hope; I along with my partner Abdul started working on creating a robust algorithm. Our approach to algorithmic trading was completely different from the traditional methods. Developers usually follow High-Frequency-Trading methods with algorithms, which use a minuscule of the total investment on each trade and tries to end each session in profit by making 1000s of trades throughout the day or any preset duration.

We did it differently. We aimed at an improved accuracy by limiting the number of trades and choosing one particular trade session, necessarily 4 hours a day, same time every day. This helped the model understand market volatility during different sessions, as many traders enter and exit the market. Finally, with the help of inducing Google’s RigL algorithm announced in 2020 September to achieve sparse neural network optimization, we decided to test the algorithm. At first, we had 80% prediction accuracy which was good to enter the real market, but we optimized further and tested the model for the same 4 hours every day and noticed that the model could predict with an accuracy of 95%. It blew our minds, and our focus shifted to making money immediately. But before we get jumped, we did our research. In the stock market, the general rule is that the more you invest the lesser the risk. This is essentially true due to the flexibility that amounts going into each trade can be adjusted according to the total investments allowing every trade to be more flexible and follow a robust risk management system. Thus we started a company to be able to invest appropriately good volumes.

History

Trading in India became possible in the late 1800s with the British invasion. In Bombay, traders used to gather around a banyan tree with a small number of stockbrokers holding each trade sheet in their hands. As the technology improved, the ‘Bombay Stock Exchange’ came into existence and trading became more popular. With the introduction of the internet and cloud-based servers, many such exchanges were established in India and across the world. Traders can now go online pick a stockbroker of their choice from 1000s of available choices, register an account, and trade from the comfort of their homes through smartphones. As India develops its’ methods and further awareness spreads across the country, many traders enter the market with so many dreams. But only those with adequate knowledge can come out with profits, the rest either suffer a terrible loss or end up being addicted to the market.

“Stock trading is firstly an emotional and secondly a statistical market” – Krishna Prasad

In the year 1996/7, Steven & John introduced Algorithmic trading; a method of automating the analysis, predictions, and trades with the help of software systems and computer machines. By the year 2020 80% of stock market volume in the western countries is generated through algorithmic ways, whereas in India, only 5% is generated through such methods. This huge difference in number is due to a lack of awareness and inaccessibility to such technology. Algorithmic trading and investment management firms in western countries are popular due to the methods of financial protection plans and insurance available in such countries. Success trading as an Investment Management firm using Artificial Intelligence based Algorithmic trading intends to introduce Indian investors to world markets and Algorithmic trading.

Investment Plans

Our algorithm has a 95% accuracy and an 8.5/10 backtesting score on the past three years of market data, during the particular sessions we trade-in. In any given 30 consecutive trade days the model can generate an average of 300% profits given the base investment is set at- at least 5000$. The math is simple; on any trade, the model uses a maximum of 2% of the total investment available. 2% of 5000$ is 100$ and it only takes 10 trades per day, each at a margin of 80% profit. This generates, 80% of 100 x 10 trades each day = 800$. The same is carried out for 30 trade days with a risk management system and an experienced trader or artificial intelligence engineer monitoring the performance. By the end of 30 trade days, the machine generates 800x30 = 24,000$, which is close to 500% of the initial investments made. Any investor can invest a minimum of 500$ to a maximum of 2000$ with us.

Challenges

Indian investors are skeptical of stock market investments. That said, it is very challenging to gather the first set of investors, given the number of scams and fraudulent advertisements on the web. Thus we registered our firm as a wealth management company under the msme act 2006 and can be openly verified with the ‘UDYAM-TS-09-0009496’ registration number. We had taken the first step and called out to investors offering 100% return of income, but this offer made a more negative impact in the market than positive ones as 100% in 45 days seemed too good to be true for many new investors who are unaware of the stock market or algorithmic trading. Thus we had decided to change all investment plans and limit the returns to a maximum of 30% starting from May 2021 sessions. Our investment plans are simple to understand and involve no big schemes to lure anyone into hidden terms and conditions. The minimum investment is set at 500$ and maximum investment is set at 2000$, maximum returns as of March 2021 are +100%.

Risks

‘Irrelevant of how good of an algorithm we use or how many experienced traders are on-board, the stock market always involves risk. Thus, in order to secure our clients and not lose their trust in case of a bad market situation, we protect our clients by baring 70% of the loss in case of such situations, limiting the investor’s risk to a maximum of 30%’, says co-founder of Success Trading Abdul Hirshad.

The techies have started their journey amongst all the good and bad feedback from the Indian market by bringing in some investors from western countries like U.S and Canada. Their start-up journey sets an example for the young entrepreneurs, of how a revolutionary tech discovery can face multiple critics before finally seeing the light.

Conclusion

AI-based algorithmic trading has now entered the Indian market with this revolutionary, first of its’ kind Investment Management firm in India, Success Trading. With success trading, new Indian investors can now explore opportunities that are commonly available to investors outside India. Covid pandemic creating a huge loss of jobs reminded everyone of the importance of securing a secondary income, and this can be a great opportunity for such salaried professionals struggling through the lockdown.

Media Contact

Success Trading admin@successtrading.co.in +918095509151 Radiance Enterprises, Hsr Layout, Bangalore-south http://www.successtrading.co.in