Ahmedabad, Gujarat Oct 19, 2021 (Issuewire.com) - Tarrakki is a new age investing app that lets Indians make DIY investments in the markets by offering financial products that allow investing with as low as Rs 100. Incorporated in 2018, Ahmedabad-based tarrakki was started by Saumya shah and Shaily shah. The investment options available to invest are:

- Direct Mutual funds – One can start investing with as low as Rs 100 and save on commissions.

- TarrakkiZyaada – This offering is in partnership with Nippon India Liquid Fund. It’s a one-of-a-kind offering as it provides an investment-linked debit card with the purchase of a mutual fund. This card can be used anywhere from your uber booking to shopping online. The amount gets deducted from your investment while keeping the remaining amount invested.

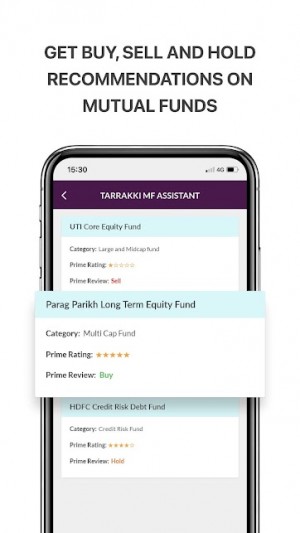

- Tarrakki MF Assistant – It provides BUY-SELL-HOLD recommendations to investors on mutual funds. It also sends a nudge if the fund has a SELL rating, and the buyer has placed an order for that fund.

- Peer to Peer lending- In association with industry partners, Tarrakki provides an P2P lending as an offering that gives an option to the investors to diversify their portfolio.

- Minor investing – Tarrakki is first of its kind platform to offer minor investing as an option for kids below 18 to invest. Tarrakki’s youngest investor is a nine-month-old toddler. Her parents are saving up for her future education from a very young age.

- Equity advisory – The subscribers are offered a well-researched model portfolio, which tells them what and how much to buy. The most important part is that it tells them when to sell as well

Tarrakki has raised $225,000 in funding so far from investors including Kiran Shetty, CEO and Regional Head India and South Asia at SWIFT; Asit Oberoi, Managing Director, Asia Pacific, at Buckzy Payments; and Safir Anand, a well-known investor, IP lawyer, and strategist.

Tarrakki generates most of its revenue from its equity advisory offering which is priced at a very low cost at just Rs 550 per month which is a quarter of the cost charged by competitors offering similar products. Tarrakki provides a subscription-based equity advisory package for mutual fund and shares investing which is priced at Rs 275 per month. This package allows access to premium features like Tarrakki MF assistant and dedicated investment advisor.

While for the P2P lending offering, the startup earns commissions from the distributors.

With lockdown and COVID-19, people have become more prudent while spending and starting their investment journey. Tarrakki aims to make investing simple and accessible with a tech-enabled approach.

Media Contact

Tarrakki info@tarrakki.com 7940039036 B-310, Titanium Heights, Opposite Vodafone House, Corporate Rd, Makarba https://tarrakki.com