London, United Kingdom Oct 31, 2019 (Issuewire.com) - London based FinTech, RedCloud Technologies, is proud to announce the launch of its innovative OCR driven digital Collections and Reconciliation payment solution, CRIBO (Cash Reconciliation & Invoicing By Optics) that will enable the global supply chain to digitise cash payments and reconcile invoices in real-time, making it possible for FMCGs and Distributors to transact safely and instantly and maintain digital records of payments. RedCloud’s CRIBO solution will allow small distributors to gain ERP efficiencies to their invoicing and payment activities without requiring investment in expensive ERP software licensing.

Currently, 10% of FMCG billings and up to 40% of their earnings require manual processing of transferred payment information when accepting payments from unbanked and cardless distributors, which takes a substantial amount of time, additional headcount and creates significant inefficiencies - RedCloud’s Payment Reconciliation solution aims to systematize the process of reconciliation of payments and subsequently grow manufacturer business as well.

At this moment in time, thousands of manufacturers and distributors and hundreds of millions of SMEs around the globe struggle with the disadvantages of costly cash payments that destabilise the supply chain and make it impossible for supply chain participants to access competitive financial solutions due to lack of cash transaction traceability, numerous errors, and risk of fraud. Today, despite advances in new technology, Distributors still commonly pay via simply depositing cash payment at bank branches to pay their suppliers on behalf of their merchants, using manual processes, to reconcile their invoices in the absence of ERP solutions, In addition, many Distributors use e-mail or Whatsapp to send information about due invoices, adding further cost, time, and loss of data to Manufacturers. d distribution networks across both Emerging, and Developed, markets in which they operate.

Commenting on the launch of CRIBO, RedCloud’s Chief Product Officer, Soumaya Hamazoui said “FMCGs will improve margins by systematizing and unifying the processing of distributor payment information (vouchers, paper invoices, credit and debit notes, sales orders, remittances, and current account statements). They will optimize decision making with real-time information: visualizing the information of customers and their behavior. Now Distributors will have a convenient solution to cancel and report their payments using technology as a change agent for efficient business and become more productive”.

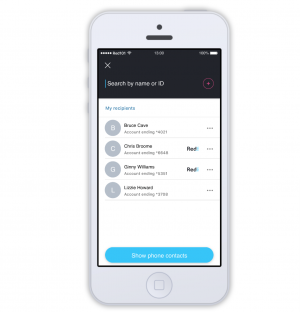

Through its open API technology, RedCloud’s CRIBO seamlessly integrates with the core Manufacturer ERP systems such as SAP and Oracle, making it easy and simple to trace back invoice payments to the relevant distributors. Through the Red101 mobile app, Distributors will be able to instantly detect the invoices that have been pushed through the API stream and identify the amounts they need to reimburse for each FMCG.

In addition to this, Manufacturers are empowered to push pending invoices through these APIs to the RedCloud system and thus collect payments faster, reconcile invoices in near real-time and streamline supply chain payment operations.

About RedCloud

RedCloud is a UK based Financial Technology company with a mission to level the financial playing field for the underbanked. Through the RedCloud platform, unbanked and banked can access the world’s first agent banking ‘super-app’, Red101 - without the need for a bank account or credit/debit card.

Downloading the super app gives users entry to RedCloud’s Unique Agency Network, which utilizes the expansive retail infrastructure that exists in markets to allow merchants to monetize spare capacity of their storefronts and provide financial services to the unbanked to make deposits, withdraw cash, transfer money, and make online and offline sales, thereby creating a Financial Services Shared Economy and the world’s first direct cash-to-mobile payments solution.

With RedCloud, unbanked users can transact without needing a debit card, credit card, or a brick and mortar bank, and do not need to maintain a minimum bank account balance, nor do they have to pay the high fees charged by banks, ATMs and payments processors.

Media Contact

RedCloud Technologies / Vik Pathak vik.pathak@redcloudtechnology.com Level 39, One Canada Square, Canary Wharf, E14 5AB, United Kingdom http://www.redcloudtechnology.com