Newark, New Jersey Dec 29, 2022 (Issuewire.com) - Designed for small businesses, ezPaycheck from halfpricesoft.com makes it easy to calculate payroll taxes, print paychecks, and print tax forms W2, W3, 941, and 940. New options for setting up tax deductions customized to individual employees make the 2023 edition of ezPaycheck payroll software ideal for nonprofits and businesses with unique tax situations. The IRS has published 2023 tax tables. The new 2023 ezPaycheck payroll software from halfpricesoft.com is shipping to nonprofits and churches with the updates for 2023 tax changes:

- Social Security Tax on the first $160,200 of employee wages: 6.2% for both employee and employer.

- Medicare tax on the first $200,000 of employee wages: 1.45% for both employee and employer.

- Additional Medicare tax on all employee wages in excess of $200,000: 0.9% for employees only.

"We intentionally engineered this software for those end-users who are not professional accountants and payroll tax experts," explains Dr. Ge, President, and Founder of ezPaycheck, "You don't even need to have much knowledge of computers. We believe small business software should be easy to use so that owners can focus their time and energy on running their businesses, not trying to figure out how to run payroll software."

Small business owners are welcome to visit https://www.halfpricesoft.com/payroll_software_download.asp and download ezPaycheck for up to 30 days with no cost or obligation.

Small businesses get unique features in the latest release of ezPaycheck payroll software:

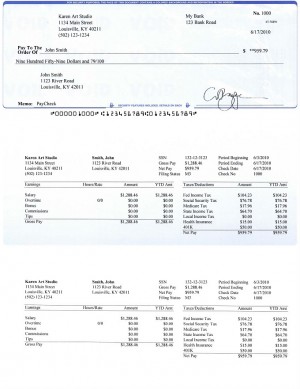

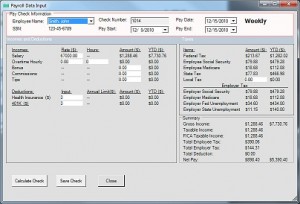

- Supports daily, weekly, biweekly, semimonthly, and monthly payroll periods. Features report functions, print functions, and pay stub functions.

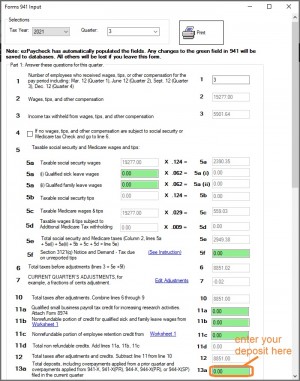

- Automatically calculates Federal Withholding Tax, Social Security, Medicare Tax, and Employer Unemployment Taxes.

-Includes built-in tax tables for all 50 states and the District of Columbia.

- Easily calculates differential pay

- Prints miscellaneous checks as well as payroll calculation checks.

- Prints payroll checks on blank computer checks or preprinted checks.

- Creates and maintains payroll for multiple companies, and does it simultaneously.

- Prints Tax Forms 940, 941, W2, and W3 (Please note, preprinted red forms are required for Copy A W2 and W3).

-Supports multiple accounts at no additional charge.

-Supports network access (additional cost)

To give small companies a jump start for streamlining the year-end tax reporting and get ready for the new year payroll, Halfpricesoft now announced the special deal of the 2022 & 2023 bundle versions at $159 only.

To start the no-obligation 30-day test drive today, please visit https://www.halfpricesoft.com/index.asp

Halfpricesoft.com is a leading provider of small business software, including online and desktop payroll software, online employee attendance tracking software, accounting software, in-house business, and personal check printing software, W2, software, 1099 software, Accounting software, 1095 form software, and ezACH direct deposit software. Software from halfpricesoft.com is trusted by thousands of customers and will help small business owners simplify payroll processing and streamline business management.

Media Contact

halfpricesoft services@halfpricesoft.com https://www.halfpricesoft.com