New York City, New York Oct 10, 2020 (Issuewire.com) - According to the official information of Fompound, the IPFS Decentralized Financial Aggregator FOMPOUND will be launched at 12:00 a.m. on October 15 and the rare dividend of the Fompound earliest mining resources will be exclusive to those who purchased the Fompound before October 2. Fompound could bring DeFi tens of billions of dollars in new assets.

I. The First "Defil" Product with "Liquidity Mining" Incentive Mechanism

Fompound is committed to building a decentralized financial aggregator in IPFS with blockchain technology, and invests in the field of IPFS including but not limited to hashrate provision. The Fompound aggregator will use Defi pledge mining and liquid mining to generate the rights and interests of the platform and Fomp token used for governance. In addition, investment from FOM-a to FOM-J in stages and in batches could generate polymerization benefits for Fomp and thus enhance the project value of Fompound.

Why is Defi Brought in to Activate Fomp?

The special pledge mechanism in the IPFS field brings two problems that must be faced: 1) Where does the token for network startup come from? 2) The contradiction between the scarcity of early token and the demand for pledge of miners' hashrate growth. The first problem is solved by the Space Race, which prefixes the accumulation of hashrate, while the second problem relies on DeFi.

As the launch date of Filecoin main network is approaching, the chain synchronization and algorithm of Filecoin are still relatively stable. Although there are some points to be discussed in the hashrate maintenance with some official and miner reasons, but generally speaking, there are no particularly big obstacles to the launch of the main network. At the current pace, when the Space Race is over, the problem of efficient storage will be gradually advanced, the ecological construction will be gradually carried out, and the main network will be put online.

But where did the initial pledge come from? So far, the Space Race has partially solved that problem. The Space Race is divided into two phases. In the first phase, more than 3.6 million FIL incentives are sent out, which will be released linearly within 6 months. In other words, the miners who took part in the test were able to get almost 20,000 tokens a day as collateral. And Space Race in the second stage solved the problem of the initial hashrate. At present, according to the announcement, some hashrate, pledge and block reward can be directly connected to the main network, which means that when the main network comes online, the hashrate is quite a lot. If the hashrate of about 100PiB is transplanted to the main network, then this part of initial hashrate can solve the issue of issuing initial rewards, and further solve the problem of excessively high initial pledge calculated at the beginning. Because of the initial hashrate, the initial pledge for each sector will be less than 1.0Fil, and it is estimated that it will be less than 0.5 Fil. This provided the impetus for the initial hashrate growth.

However, with the release of the new economic model, the issue of pledge appeared again in front of the screen. People are still worried about it. This is especially true for miners. A simple simulation shows that miners who continue to increase their hashrate, so in the first half of the year they're almost all investing. Although their paper profits are good, but their actual funds are either pledged or locked up, in short, funds can not be drawn out. In the early days of Filecoin network, the increasing hashrate accounted for too much of the total hashrate, which required a large number of released tokens to be circulated into the system and pledge system. However, it is difficult to realize the above situation. According to the traditional model, it will lead to the scarcity of tokens and the price of tokens will soar. In this case, people will be more willing to hold tokens. Instead, it causes a shortage of circulation. So is there a solution to this situation? Yes, it is “DeFil - Decentralized finance of Filecoin=Defi+IPFS”.

Ii. Fompound Arrived on the Wings of "Defi+IPFS"

One of DeFil's main goals was to increase the liquidity of the currency in circulation. That means finding ways to get people to take their tokens out into the market instead of sleeping in their personal wallets. One of the simplest incentives is to pay interest. Another is liquid mining, which gives everyone tokens as well as interest. As long as people have the opportunity to make money, then the money will naturally come out into the market.

This is also exactly consistent with the technical core of Fompound, which is to generate interest by depositing and lending, and to carry out additional allocation of Fomp. The basic principles of Fompound can be divided into: deposit and lending interest rate model, clearing mechanism, Fomp allocation mechanism, administrator review mechanism, and blockchain entity mining income mechanism.

The appearance of Fompound first relieved the miners' urgent need for collateral after the launch of the main network, which was conducive to the expansion of the Filecoin network and enabled the borrowers to make profits through DeFi, which to kill two birds with one stone, or to become a model for the mortgage market.

At the same time, Filecoin takes advantage of the market and customer browsing needs to make its financial value take root. This is another important Filecoin action -- to maximize token utilization and economy.

Iii. How does Fompound Release Liquidity?

A total of 1 million Fomp were issued. The project party did not reserve them, and the whole amount was allocated to the community for liquidity mining. The Fomp enjoys the governance authority of the Fompound platform and the 80% of the income distribution right of FOM-A....J project.

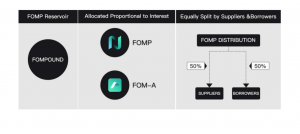

(Fompound’Platform Token: Logical Chart of Fomp)

Creation Logic of FOMP

- The Fomp will be placed in a largepool (Smart Contract) and 0.1 Fomp will be rotated out of each ethereum block, which means about 576 FOMPs will be produced every day, and the output of each 50,000 Fomp will be reduced by 20%.

- Fomp will be allocated to each reception market (FOM - A... J), according to the proportion of assets in each market in the total assets, which also means that the distribution proportion can change at any time;

- In each market, 50% of Fomp provider will be allocated to the assets, 50% will be allocated to the borrower, and users can obtain according to the proportion of their assets in the market they are in;

- Once 0.001Fomp was obtained at aaddress, the trading of any Fompound corresponding Fomp will be transferred to their address. As for the smaller number, Fomp can also be collected manually.

The Core Logic of FOMPOUND

Liquidity mining for many DeFi projects is the process of allowing users to deposit or lend specified encrypted assets as required to provide liquidity to the capital pool of DeFi products and thus generate revenue. Similarly, Fompound invested FOM-A(once issued, never additional) with all the hashrate used to invest in Hellofil(fourth place in global IPFS effective hashrate). This method is similar to using Compound method to pledge the usufruct to prove Fomp. In other words, as long as the user deposits FOM-a to FOM-J or borrows the cryptoasset (Fomp) from the Fompound platform, he or she is involved in Fompound's liquidity mining. Such the liquidity mining mechanism not only increases the liquidity of tokens, but also helps the cold start of the project.

Advantages of Fompound Platform:

- Decentralization: Individuals with asset management needs do not need to trust any intermediaries, and the new trust is rebuilt on machines and code;

- Community Autonomy: Everyone had access rights, and no one had central control, and everyone with FOMP consensus had the right to vote.;

- Open Source: All agreements are open source, so anyone can build a new agreement on cooperation in financial products, and to speed up financial innovation under the network effect.

- Real Assets Endorsement: With the endorsement of blockchain entity income, the platform token not only has the benefits of regular mining income and airdrop, but also the investor income is guaranteed.

FOM-A Target Advantage

FOM - A, is based on Fompound decentralized financial aggregator IPFS first hashrate to provide investment income, issued a total of 14 million (20% of the investment income will be used to repurchase&destroy FOM - A, until the repurchase is greater than or equal to the total value of 11.2 million USDT or repurchase FOM - A number greater than or equal to 11.2 million), to the FOM - A: USDT = 1:1 price for sale.

It is worth mentioning that Fompound has received full support from Hashrate ark &HelloFil, providing IPFS with no less than 10000T of spot hashrate for 360 natural days. The hashRate of purchase has completed heshrate filling and pre-pledge.

With reference to the mining of traditional IPFS economic model, all mining machines must first complete the pre - pledge. The calculation according to the hashrate of 10000 T, FOM - A saved at least 3 million USDT value FIL pledge cost, at the same time, calculated from the date of the start of the main network, Fom-A begins to generate revenue at least 100 days in advance, which results in cost savings and early earnings, and greatly reduces the risk of investment.

Second, compared with the traditional tedious investment process, Fom-A's advantages are even more significant. The 10000 Hashrate invested by FOM-A is the competition mining machine used in the recent official hashRate competition. It is filled with the hashrate that has completed the pledge and the full hashRate fill. From the first day of the launch of the main network, spot can be produced and profits can be obtained, so there is no filling time and it can be realized at any time, and then based on the mining of double pledge before and after IPFS economic model, output FIL in the early market demand is huge. In addition, the mining mechanism of Fompound itself, which automatically cycled "destruction + repurchase FOM-A", would promote the price of Fomp to increase continuously, and one token that was difficult to obtain would be fully demonstrated by Fompound.

Third, after the initial issue, there will be a continuous cycle of repurchase and destruction of FOM-A, which will continue to drive the price of FOM-A up. By pledging FOM-A to participate in Fomp's liquidity mining, investors of FOM-A will get Fomp free of charge, and get FiL air drop by holding Fomp. You will get three returns on one investment, which will fully ignite the enthusiasm of mining in the market.

Note: If the total amount raised is less than 7 million USDT, the project will be officially declared a failure and the original address will be 1:1 to return the investment money.

Conclusion

Filecoin's goal is to build the world's largest network of distributed storage to host and stored data. If we achieve this goal in the long run, the most important human data will be hosted on the Filecoin platform, which will be priced with FIL, and let's find some reference values to value the most important human data. We now have the top 10 of the traditional Internet, including Amazon, which holds most of the human data, which is part of the public data, so the top 10 Internet companies are worth about $6 trillion or so. Let's assume that the value of 6 trillion dollars is the important data of the whole mankind. As long as it is long enough, it will reach 100%. And once we get to $6 trillion we're going to evaluate it with Fil. 6 trillion divided by 2 billion is equal to 3000 dollars.

If you go up to $3,000. If the main network is more than 1% complete in our psychological sense, then it's worth more than $30. However, each person had a different price in mind. If the main network was successfully launched at 2%-5%, it would be worth a lot. If calculated at 5%, the price would be $150. However, FIL only provided one million Coin for the final test of the network, while Fompound was far ahead of FIL.

On October 15, Fompound was about to come online to seize Defi Pledge & Liquidity Earliest Mining and Fomp would support ecological development. (Fompound has received investments from a number of institutions, including Cryptocapital, BKEX Capital, S.Capital, Geek Capital, Lighting Capital, Geekbeans Capital and Oaktree Capital.)

- The subscription quota before October 2,and Fom-A will be issued on October 3;

- The subscription quota is from October 3 to October 10, andFom-A will be issued on October 16;

- The subscription quota is from October 11 to October 12, and Fom-A will be issued on October 17.

- The subscription quota is from October 13to October 14, and Fom-A will be issued on October 18.

- The subscription quota is onOctober 15, and Fom-A will be issued on October 19.

- For the quota subscribed on or after October 16,so the time for setting aside money shall be postponed accordinglyevery two days. Example: The subscription quota was issued from October 16 to October 17, and Fom-A was issued on October 20.

Remark:

- All the dates shall expire at 00:00 on the same day;

- Fompound was launched on October 15.

In the future, Fompound will continue to carry out institutional cooperation, product research and development, implement application, overseas development and recruitment of ecological developers. All users with research and development capabilities and friends who want to know more about Fompound are welcome to join Fompound's ecology.

Contact US:

Fompound website: https://www.fompound.com/

Official Customer Service of VX: Lah123456777

Media Contact

Fompound *****@globalnewsonline.info