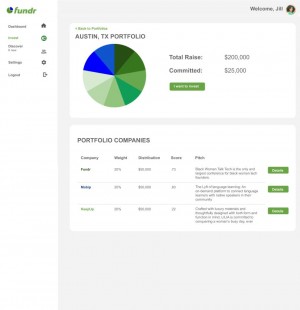

Austin, Texas Oct 29, 2020 (Issuewire.com) - Fundr, an investment marketplace that puts the power of Artificial Intelligence (AI) and portfolio diversification in every startup investor’s hands, announced today the release of its first portfolio of companies. Fifteen companies were selected from over 450 global startup applications, representing 10 diversified industries. Fundr is raising an inaugural $1.5 million to invest $100,000 in each startup via convertible notes and prove its thesis that startup investing is ready for change. Fundr is accepting accredited investors on its platform to invest in the portfolio.

“Startup investing is long overdue for disruption,” said Lauren Washington, co-founder of Fundr. “The process is long, inefficient, and biased. It takes investors about three to five years to build a diverse portfolio of startups. Who gets funding is still determined by warm introductions, pattern matching, and bias. And it’s not working - 90 percent of angel investors’ portfolios fail.”

Fundr’s proprietary technology enables startup founders to share in-depth quantitative data about their market, traction, team, and background. Each startup then receives a Fundr Score™ which determines eligibility to use the platform and how much they’re able to raise. Accredited investors using the Fundr platform can then easily diversify their funding into a portfolio of vetted startups. Investors also benefit from key features like standardized term sheets, automatic money transfers, and productive communications tools that enable relationship-building with investees.

“Fundr’s algorithm collects 90 pieces of data on every startup on our platform,” says Boris Moyston, co-founder of Fundr. “Achieving that level of due diligence is difficult for any investor, so a lot of startups get funding because they are able to tap into a network of existing relationships. We want to remove that subjectivity from the process and help investors find and invest in strong startups they may have never heard of otherwise.”

Fundr’s first portfolio exemplifies that diversity. Ten different industries are represented in the portfolio, including clean energy, AI, blockchain and fintech. Seventy-five percent of founders are located outside of tech hubs like Silicon Valley and New York City. 56 percent of founders identify as underrepresented people of color, and 44 percent of founders identify as female.The average Fundr Score™ of the companies in the Fundr portfolio is 85, out of 100.

“Technology can be a great equalizer,” says Jean-Philippe Desmontils, Chief Technology Officer of Fundr. “Investors and founders alike can use quantitative analysis to their advantage. Founders can quickly see gaps and opportunities in their businesses, and investors can use the data to make smart decisions.”

While there are over 13.6 million accredited investor households in the United States, only three percent are active angel investors. The barriers to investing are primarily time, education and access to credible startups. At the same time, research from AngelList shows that broad indexing at seed stage outperforms individual investor selection by 90 to 95 percent over 10 years.

“Fundr was developed to help investors vet and invest in a diversified portfolio - and it works,” says Washington. “We tested our algorithm at the Black Women Talk Tech international pitch competition this year. Over six hours, a seasoned team of investors deliberated which startup should win the $15,000 in award money. Fundr’s algorithm predicted the winner automatically. Put simply, Fundr is the future of investing.”

Companies in Fundr’s first portfolio:

- At Ease Rentals Corporation connects military personnel and federal employees with housing

- CoCaptain is a virtual coaching platform that makes coaching affordable and accessible for all

- CoCensus provides real-time qualitative data and reports on economically distressed communities for municipalities, real estate firms, and community stakeholders

- ConferenceCast is a premier knowledge platform, aggregating on-demand video content from conferences for professionals looking to upskill themselves

- Edifius enables any small business to have an AI-powered customer service department via its voicebot - without adding payroll

- Evrmore is the first for-benefit social technology built for judgement-free social and emotional wellness powered by Empathy AI™

- FairFare is a direct booking ride hail platform that allows you to choose your ride

- Healthy Hip Hop delivers the Sesame Street of the 21st Century

- HVACIntel helps contractors and homeowners detect and predict HVAC failures before they happen

- LAMIK is a tech-enabled clean beauty brand for women of color

- Noonean Inc integrates Voice AI Assistants with cognitive search to provide next generation information access

- Optimal Technology Corporation is an award-winning, venture-backed, minority-owned, energy solutions provider lowering electricity bills by 70 percent using ML-enabled monitoring solutions and efficient energy technologies

- RoundlyX is Mint.com for digital assets, enabling customers to invest spare change in cryptocurrency

- Steamchain Corp is a FinTech company that simplifies international B2B payments

- teleCalm is a stress-free phone service for seniors, stopping problem calls for families living with Alzheimer’s and dementia, including late-night calls, repeated calls and 911 abuse

About Fundr

Fundr is an investment marketplace that puts the power of AI and portfolio diversification in every startup investor’s hands. Fundr creates diversified startup portfolios by leveraging deep quantitative analysis to assess investment potential. Now in beta, Fundr predicted the winner of the Black Women Talk Tech international pitch competition and was accepted into the prestigious Sputnik Accelerator, all while attracting hundreds of investors and 450 startups on the platform.

Fundr Team

About Lauren Washington:

Lauren is the co-founder of Black Women Talk Tech, the largest membership organization and only conference for black women founders. She is also the cofounder of Fundr, a platform that automates seed investing by creating portfolios of vetted startups for angel investors.

Prior to this, Lauren founded KeepUp, a social listening platform. Her companies have won multiple awards including 43North and the Advanced Imaging Society’s Distinguished Leadership Award. She has been featured in The New York Times, Elle, Inc., and Black Enterprise and has been listed as a top female entrepreneur in CIO Magazine, Essence Magazine, and Entrepreneur Magazine.

Lauren started her career as a special education teacher with Teach for America and went on to develop marketing and data strategy for over 100 global companies. She has her BA from the University of North Carolina at Chapel Hill and her MBA from Northwestern’s Kellogg School of Management. She is on the board of advisors for SXSW Pitch and is the viceboard chair of Talk Tech Association and on the board of directors for Women@Austin.

About Boris Moyston:

Boris is a cofounder of Black Men Talk Tech, a tech collective and conference series promoting elite Black tech entrepreneurs and innovators. He also co-founded MOBIP Technologies, an enterprise mobile payment platform operating in Europe and North America as one of Stripe’s Global Payment Partners. Boris is a co-founder of Fundr.

Prior to Fundr, Boris advised family offices and non-profits in the Investment Management Division at Goldman Sachs. He was a securities trader at Citigroup and an Investment Banker at the Royal Bank of Scotland.

Boris started his career as an investment specialist for a private equity group. He holds a BA in Economics and Philosophy from Brandeis University and an MBA in Entrepreneurial Innovation and Investments from The Fuqua School of Business, Duke University. He is a former Member of the Board Of Directors at the Peter Westbrook Foundation, a sports organization which turns urban youth into Olympic and World Fencing Champions.

About Jean-Philippe Desmontils

Jean-Philippe Desmontils is an EPM and business intelligence expert with 20 years of experience in financial services and API development. He has a BA from Université Claude Bernard Lyon 1 and Masters in Computer Science from Pierre and Marie Curie University. His most recent startup, MOBIP, processed over $20M in payments and was one of Stripe’s global payment partners.

Media Contact

Fundr lauren@fundr.ai https://www.fundr.ai/